are funeral expenses tax deductible in canada

Schedule J of this form is for funeral expenses. A simple direct cremation in Canada can start at around 600 whereas a cremation with a service and extra disbursements obituary notice viewing funeral flowers etc may cost in the region of 4500.

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

The fees for the memorial service whether religious or not.

. The expense of a funeral can also be deducted in the context of Inheritance Tax. The IRS views these as the personal expenses of the family members and other people in attendance and therefore doesnt allow them as deductions. Although a funeral home is going to surcharge that and you might see 10000 expenses if youre not careful.

The funeral homes viewing and visitation fees. If the beneficiary received the death benefit see line 13000 in the Federal Income Tax and Benefit Guide. There are no deductions for funeral expenses included in medical expenses because the IRS allows deduction for these types of expenses.

In short these expenses are not eligible to be claimed on a 1040 tax form. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. When Funeral and Cremation Expenses are NOT Tax-Deductible.

Retraite Québec will reimburse the person who paid for the funeral expenses related to the disposition of the body and the funeral up to a maximum of 2500 upon presentation of receipts. Rules for Claiming Funeral Expense Tax Deductions. Legacy Headstones is frequently asked whether funeral expenses are tax deductible.

The Canada Pension Plan pays a flat 2500 death benefit to the estate. Embalming of the body. The cost of the cremation urn and niche.

As mentioned above cremation service costs will vary depending upon your province and area. The cost of the casket. Up to 10000 of the total of all death benefits paid other than CPP or QPP death benefits is not taxable.

While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs. Confirm what resources are or may be available for funeral costs including the deceased persons assets resources available from any of the responsible persons contributions from family members and possible alternate sources of payment for funeral costs. The CRA specifically cited the following examples of expenses that are non-deductible but tend to be claimed erroneously as other or additional deductions on these lines.

Many estates do not actually use this deduction since most estates are less than the amount that is taxable. For 2019 estates that are under the 114 million threshold do not need to deduct expenses since they are not liable for any estate tax. The cost of a funeral or cremation is influenced by where it takes place.

If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. However if your estate is below the 12060000 federal estate tax exemption limit 2022 tax year you cannot use this. However executors of estates that are subject to tax can use various deductions including.

This means that you cannot deduct the cost of a funeral from your individual tax returns. The passing of a family member can prove difficult and the added stress of managing monetary concerns makes for a truly unpleasant time. A typical traditional funeral with a viewing or visitation and reception in Canada costs between 8000 and 10000.

In other words funeral expenses are tax deductible if they are covered by an estate. In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes. The deceaseds estate must have paid for any.

This link will open a new tab. Answer No never can funeral expenses be claimed on taxes as a deduction. What Funeral Expenses Can Be Deducted From An Estate.

Death benefit is taxable. The IRS deducts qualified medical expenses. Funeral costs in Canada can be as low as 1000 or as high as 20000 with the average around 9150.

The finances associated with funerals can prove exorbitant and if you are not prepared to cover the costs it can prove devastating. It was 117 million in 2021 1206 million in 2022 at the federal level while its only 1 million in Oregon. A traditional funeral with direct cremation and a family-organized reception without a viewing or visitation may cost.

The amount of these exemptions can vary. Low rates start at 15month. The following expenses can be claimed.

That depends on who received the death benefit. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. The following is a non-exhaustive list of accepted expenses.

The Internal Revenue Service IRS sets strict rules about what expenses can and cannot be deducted from your tax bill. 99 Acceptance rate and no medical exam Get a Free Quote. The cremation rate in Canada is at 65 making.

This is due within nine months of the deceased persons death. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate. Most people know that the costs of funeral services and products are rising.

Estates try to claim as many deductions as possible to decrease net value and possibly dodge the estate tax particularly when the estate is close to surpassing the exemption threshold. Are Funeral Expenses Tax Deductible In Canada. A couple of funeral expenses are not eligible for tax deductions.

Body transportation and embalming fees. These need to be an itemized list so be sure to track all expenses. They are never deductible if they are paid by an individual taxpayer.

Contact Service Canada regarding eligibility for the CPP Death Benefit. Provided the deceased gave entitlement to that benefit. Although we cannot provide tax legal or accounting advice we know that planning and preparing the funeral of a loved one can be stressful.

Any travel expenses incurred by family members of the deceased are not deductible. Can funeral expenses be claimed on taxes as a medical expense deduction for an immediate family member or dependent who has recently passed away. Thursday May 31 2018.

A death benefit is income of either the estate or the beneficiary who receives it. As with real estate automobiles food and pretty much everything else how much you pay for goods and services varies according to where you are. Ad We help seniors afford their funeral and end of life needs.

Legal fees you paid to get a separation or divorce or to establish custody for a child funeral expenses wedding expenses loans to family members that presumably went bad and a. Thats taxable in the hands of the ultimate. Transportation storage and preservation of the body.

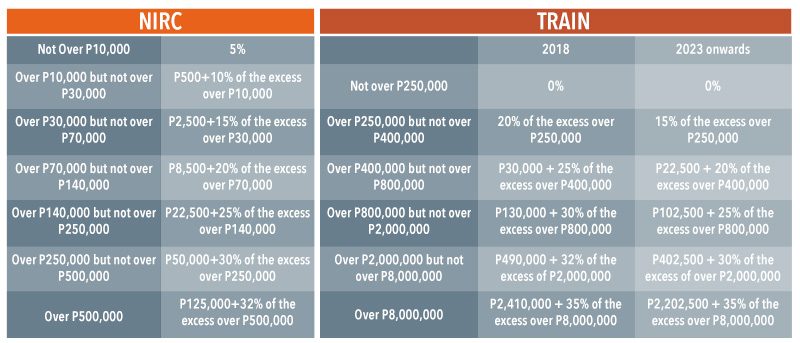

Prelim Examination Business Tax Pdf Tax Deduction Estate Tax In The United States

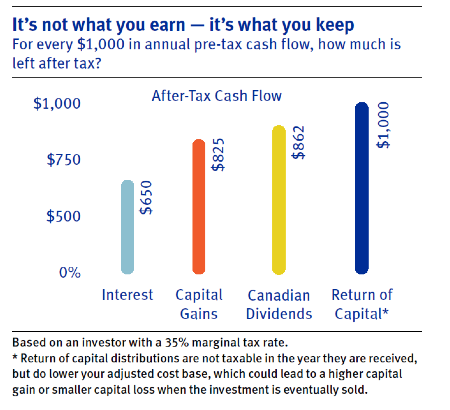

Insurable Interest Canada S 1 Life Insurance Blog

Opinion Train Law What Does It Change

After Death Executor Guide For British Columbia

Gaps In Income Tax Knowledge Could Be Costing Canadians Maple Ridge News

Client Advisory Letter July 2017 Pwc Philippines

After Death Executor Guide For British Columbia

After Death Executor Guide For British Columbia

After Death Executor Guide For British Columbia

After Death Executor Guide For British Columbia